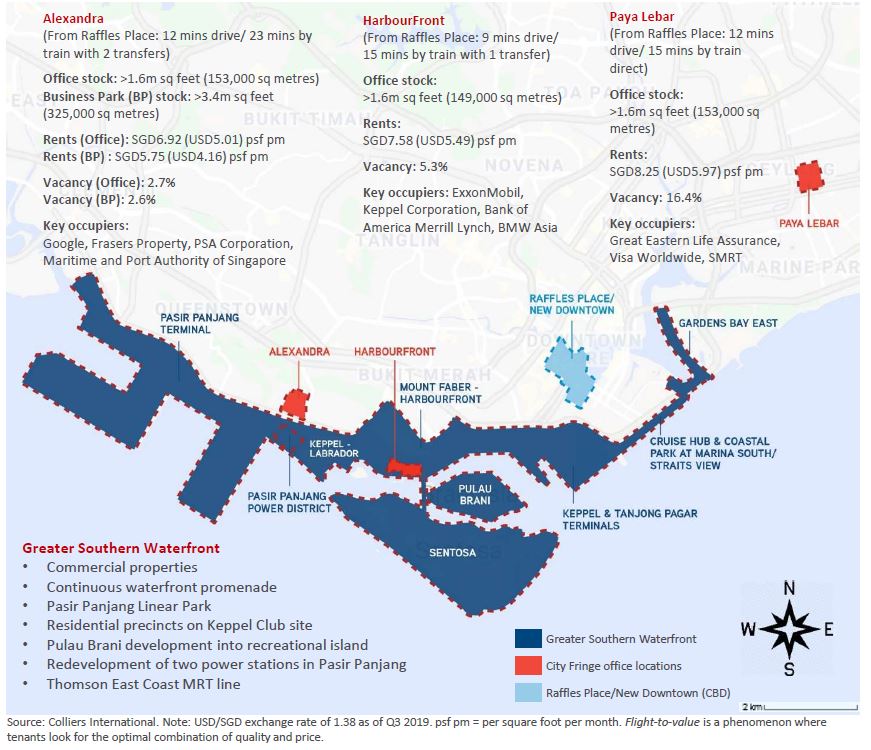

To pursue better affordability and value, Singapore CBD office tenants are moving to city-fringe locations that provide Grade-A office spaces at lower rental rates.

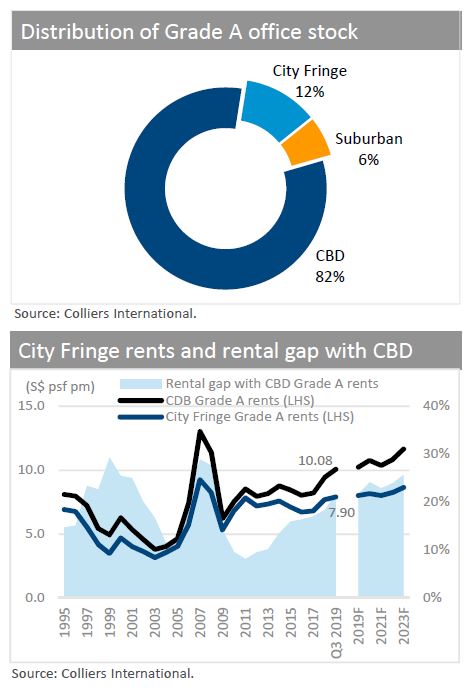

In “City Fringe Gems,” a research paper from Colliers International, it was discovered that the average monthly rent for Office spaces of Grade-A located in the city-fringe was $7.90 psf in 3Q2019, which is lower than the $10.08 psf average monthly rent in the CBD during the same period.

The report states that there has been an 18.4% increase in the rent of Grade-A office spaces in the city-fringe locations between 2Q2017 and 3Q2019, due to favorable demand-supply conditions.

Additionally, the rent gap between the city-fringe locations and the CBD has widened from 8% in 2011 to 22% at present, as per the report.

Tricia Song, the Singapore head of research at Colliers International, has stated that the value proposition of city fringe business locations has improved significantly in recent years.